- Home financing assumption occurs when the client takes over new seller’s existing mortgage within closure rather than taking a special loan.

- Already, really the only fund which have a fundamental qualifying presumption clause are Virtual assistant, FHA and you can USDA loans.

- Veteran-to-veteran presumptions out of Va fund ensure it is people in order to substitute the Virtual assistant entitlement on the mortgage and launch the latest seller’s entitlement for use toward a future Virtual assistant loan.

When rates of interest go up, consumers are usually compelled to build difficult selection regarding the costs out of housing. Large prices, along with the important upsurge in home values over the past long-time, has pushed of numerous people outside of the homebuying field totally.

not, one sector of your real estate market-the mortgage expectation market-comes with the potential to outperform the others. Wise agents is also influence its knowledge to create certain percentage-sensitive and painful subscribers back once again to the newest hunt for a new family.

A mortgage expectation occurs when the client gets control the fresh seller’s current mortgage within closure in the place of getting an alternate financing.

Deborah Baisden, CRS, GRI, a profits relate genuinely to Berkshire Hathaway Domestic Features within the Lynnhaven, Va., has actually seen an enthusiastic uptick within the Va assumptions within her business. Regarding twenty two% of your society try armed forces, she states.

Already, the only loans in the market which have an elementary being qualified expectation condition try Virtual assistant, FHA and you will USDA loans

Whenever Baisden started in the firm inside the 1989, assumability was extremely preferred, however it try a pretty extended processes. They’ve been expediting it today. She recently signed a-sale in which a veteran client presumed good 3.5% financing. New sale closed in forty five months.

All these financing had been originated otherwise refinanced after and you can hold very low interest rates and you can payments, claims Craig O’Boyle, broker-holder from O’Boyle A house Category inside Texas Springs, Colo.

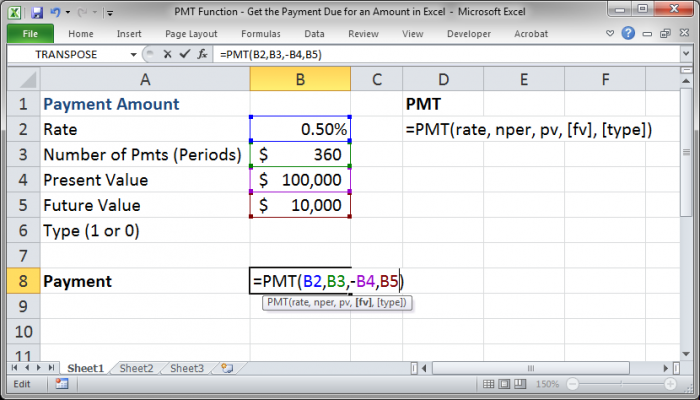

Record agencies offering these properties still have to focus on the traditional big around three selling factors- location, household has actually additionally the overall updates of the home-even so they ought to be marketing this new coupons people is also realize whenever they be considered to assume the present reduced-price financial, O’Boyle says. While a good $three hundred,000 loan at a two.5% interest rate in the place of getting a separate mortgage on a good six% interest signifies $614 monthly into the savings.

For many realtors, there clearly was a degree gap out-of mortgage assumptions, claims O’Boyle. That is understandable offered presumptions have not been prominent because the mid-eighties, ten years whenever interest levels averaged a dozen.7%.

For example Baisden’s sector, the fresh new Texas Springs city is home to lots of military basics, additionally the U.S. Air Force Academy-and you may need for Va assumptions reach collect inside 2022. Expenses McAfee, chairman of Kingdom Term when you look at the Colorado Springs, saw assumable get contracts getting into work. However, you will find no actual clearness regarding the representative society for the how to over one effortlessly, according to him.

Whenever people give a hefty sum of money so you’re able to closing, Baisden reminds them that future value is never certain

McAfee and you can O’Boyle, who may have held it’s place in the business twenty-seven years, teamed as much as carry out Presumption Possibilities, worried about permitting representatives https://elitecashadvance.com/personal-loans-la/ get customers and you can suppliers courtesy an effective Virtual assistant home loan presumption. O’Boyle says agents should know this type of extremely important things throughout the home loan presumptions.

- Virtual assistant, FHA and you can USDA mortgage loans all hold a qualifying assumable condition, meaning that any holder-occupant visitors can also be be considered utilizing the same simple the loan is actually granted below toward present financial servicer. Buyers you should never guess these types of funds.

- Va money might be believed of the both pros and you can non-veterans. Veteran-to-experienced presumptions allows the buyer to replace their Virtual assistant entitlement onto the borrowed funds and you may discharge the newest seller’s entitlement for usage into a good coming Va loan. Veterans exactly who allow it to be a presumption of the a non-experienced exit the entitlement behind till the loan are paid down-while others will simply sell veteran-to-experienced. The brand new FHA & USDA have no such as for example entitlement items. For every single situation differs. In most times, providers need accredited legal services to make certain they aren’t accountable if the people default with the home loan.

- Assumption Alternatives is the difference in the purchase price and you will the new assumable home loan count while the presumption pit. The theory is that, that pit will be funded however,, because buyers are licensed from the current mortgage servicer, any extra financing make a difference to the latest customer’s power to get approval to take along side financial. O’Boyle says, for the majority new data files canned by Assumptions Possibilities at this point, this new pit has been covered with a cash advance payment. All of the visitors who has got attempted to money brand new gap could have been denied because of the servicers.

Inside the Baisden’s sales, the new seasoned buyer lead $25,000 when you look at the bucks towards the romantic. We’re going to get a hold of specific growth in assumptions if the providers try sensible and you will ordered before huge runup, she states. I caution individuals who render cash that there’s zero make certain they’re able to have that cash return away as soon as we sell.

To help home practitioners see the of numerous subtleties of product sales assumable assets, Presumption Choices offers webinars, podcasts and you can local training so you’re able to agents across the country.

We have been watching need for assumptions expand significantly, O’Boyle states. Even in the event much of our hobby is within the Tx Springs city, we’re currently control selling away from Alaska to help you Florida. In the act, he and you will McAfee are not just helping representatives as well as easing the process for servicers who aren’t onboard to the processes. Oftentimes they’re offering completely wrong advice so you can people, O’Boyle states, so we help handle the errors.