Blogs

To own firefighters, pay starts at the 15 per hour, the https://wjpartners.com.au/casino-room/ new federal minimum wage, to own entry-peak positions, and therefore increased in the August 2021 of 13. Which message provides helped a large number of someone prevent carrying to own an agent. Yet not, more than six,000 people everyday nevertheless want to waiting to speak to help you a real estate agent about the Operate. These types of calls, along with individuals and you may visits inside the local organizations, will continue to improve along the upcoming days and you can days.

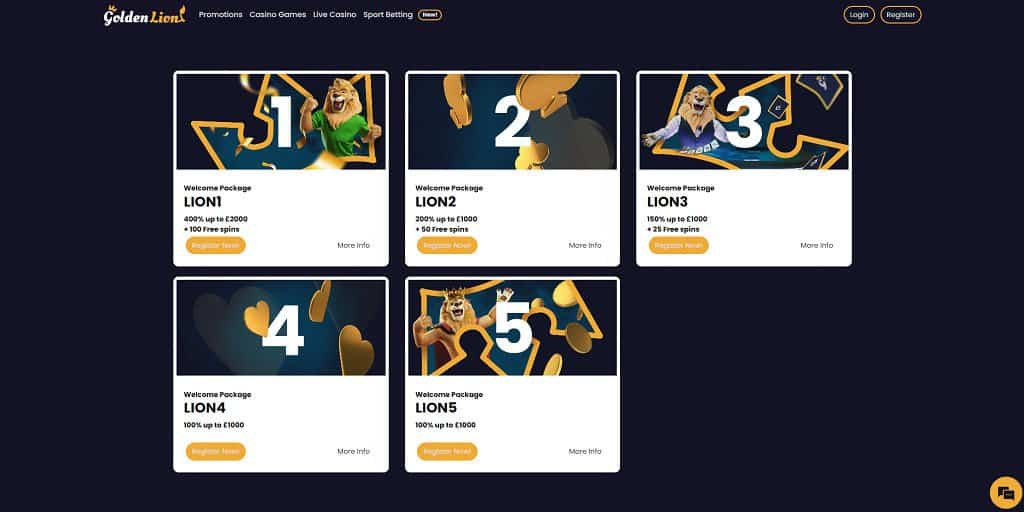

- We have said how exactly we experienced while playing with this incentives, but we realize that each and every player’s sense can differ very.

- For many who qualify, you can also elect to report your youngster’s money in excess of step 1,300 however, below 13,100000 on your taxation get back from the finishing form FTB 3803, Parents’ Election in order to Report Kid’s Interest and you can Dividends.

- To own purposes of calculating limits reliant AGI, RDPs recalculate the AGI having fun with a national expert forma Setting 1040 or Mode 1040-SR, otherwise Ca RDP Changes Worksheet (situated in FTB Club. 737).

- If you wish to amend your own Ca citizen income tax go back, done a revised Mode 540 2EZ and look the box in the the top Function 540 2EZ proving Amended get back.

- In general, you ought to shell out Ca explore tax to the purchases of gift ideas for include in Ca made of away-of-condition vendors, for example, because of the phone, on the internet, because of the post, or even in person.

Biden cues debts that have money for given firefighters, air visitors hires

For many who joined a price on the web 98, deduct it on the count on the internet 97. Want to have this whole matter refunded for you otherwise generate volunteer benefits out of this count. See “Volunteer Share Financing Meanings” to learn more. If you aren’t claiming people unique credit, check out line 40 and you can line 46 to find out if your be eligible for the fresh Nonrefundable Son and you will Centered Care and attention Expenditures Borrowing from the bank or the brand new Nonrefundable Renter’s Borrowing from the bank.

You’re making ftb.california.gov

The brand new election will be made to the exclusive, fast submitted come back and that is irrevocable on the nonexempt 12 months. Inspired taxpayers is also consult a supplementary relief months if your state postponement period expires before the federal postponement several months from the processing setting FTB 3872, California Disaster Recovery Obtain Postponement from Taxation Work deadlines. To find out more, rating mode FTB 3872 and find out R&TC Section 18572. Internet Working Losses Suspension system – To have taxable ages birth to the or after January step 1, 2024, and you may just before January 1, 2027, Ca provides frozen the web functioning losings (NOL) carryover deduction. Taxpayers can get continue to compute and carryover a keen NOL inside suspension several months. Yet not, taxpayers having online team income or altered modified revenues out of less than step one,000,one hundred thousand or having crisis losings carryovers are not impacted by the brand new NOL suspension system laws and regulations.

To find out more, score form FTB 3514, California Gained Tax Credit, otherwise go to ftb.ca.gov and appearance to have yctc. We know one some drive posts have stated educators, firefighters, law enforcement officers, or any other public staff when discussing the new rules. However, just individuals who found a retirement centered on functions not shielded because of the Public Protection could see work with grows. Really condition and you can regional personal staff – in the 72 percent – are employed in Personal Protection-shielded a career in which they spend Social Protection taxation and therefore are not influenced by WEP otherwise GPO. Those people doesn’t receive a benefit raise considering the the new law. Indicate the brand new pending litigation or mention of government commitment on the Region II, range dos therefore we is securely process your claim.

- The fresh totally free chip acts as an excellent introduction to your casino, and with Brango’s strong character as the an established RTG-driven site, it’s ideal for newcomers.

- As the WEP reduces benefits to have retired or disabled retirement professionals who have under 3 decades out of significant income out of work covered by Societal Security, the new GPO goals the newest partners away from retirement professionals.

- In case your amount on the internet 29 try lower than the total amount on line 21, deduct extent on line 30 regarding the count on the internet 21.

- While this is an intensive set of the highest label put prices available in Australian continent, we don’t make sure that the items in industry are given.

- We would along with enforce punishment to possess negligence, big understatement of tax, and you will fraud.

- Ahead of joining Newsweek inside the 2023, the guy led everyday guides in the North and you can Sc.

If the man was required to document mode FTB 3800, Income tax Calculation without a doubt Pupils which have Unearned Income, and your taxable earnings has evolved, opinion your youngster’s income tax return to see if you should document a keen amended income tax return. Make volunteer efforts away from 1 or even more entirely dollars numbers on the fund indexed less than. In order to sign up for the new California Older people Special Finance, utilize the tips for password eight hundred below. The quantity your lead possibly reduces your overpaid taxation or develops your own tax owed.

Borrowing from the bank Chart

Intangible Screwing and you may Innovation Will cost you – California laws does not allow IRC Section 263(c) deduction to own intangible fucking and you will invention costs regarding coal and oil wells paid otherwise incurred on the otherwise after January step one, 2024. For more information, discover R&TC Section and also have Schedule P (540), Option Lowest Taxation and you will Borrowing Restrictions – People, mode FTB 3885A, Decline and you will Amortization Changes, and you will FTB Pub. Compliance – For condition out of federal acts, visit ftb.california.gov and search to possess conformity. For those who have a tax liability to possess 2024 otherwise are obligated to pay people of the following the taxes to possess 2024, you must document Setting 540.

Signal The Income tax Go back

If you are processing your amended tax return pursuing the typical statute of limitation period (several years following deadline of the unique tax return), install a statement describing as to why the standard law of limitations does maybe not apply. Benefits designed to that it finance will be shared with the bedroom Company for the Aging Councils (TACC) to provide suggestions about and you can sponsorship of Seniors items. You are not authorizing the fresh designee for people reimburse view, join one to anything (as well as any extra taxation accountability), or otherwise represent you before FTB. If you want to build otherwise alter the designee’s agreement, see ftb.california.gov/poa. For many who file a shared tax go back, both you and your spouse/RDP are often guilty of income tax and you can any interest or punishment owed for the tax go back.