Resident Highlights

Could you like your area and exactly about where you happen to live but are not delighted with your household in itself? It would be time and energy to renovate your house. Today we’re going to speak about five a method to fund your property restoration inside Tx.

If need more space to suit an expanding family relations, dream about a luxurious grasp restroom, otherwise desire a walk-within the case, home home improvements allow you to maximize your home’s prospective. Concurrently, specific upgrades alter your house’s energy savings and increase your home’s resale worth.

Of several home owners delay house home improvements because they don’t envision it can afford all of them. not, there are many different methods purchase home improvements and you will cut money in tomorrow. In today’s blog post, I’m providing five resource options that will help build you to renovation takes place!

Tap The House’s Collateral

A house equity financing with a moment financial makes you take-out a loan based on the value of your house. Fundamentally, you place your house up because collateral so you can safe financing. This financing performs like most most other, nevertheless notice try tax-deductible!

The next home loan will be a great way to utilize your own collateral so you can pay for a house renovation within the Texas. Its a smart capital if you use they to evolve your own residence’s worth. It is a practical choice for home owners that have a low interest rate on the first-mortgage who wouldn’t make use of refinancing their fresh financial.

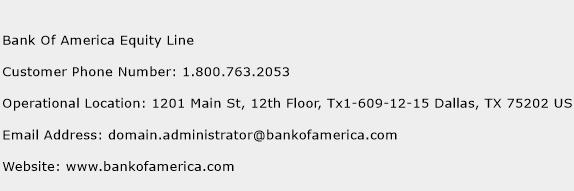

Family Collateral Line of credit (HELOC)

Just like a house collateral loan, you might open a credit line centered on the home’s security. The real difference is the fact that it loan features instance a charge card- you could potentially withdraw money when it’s needed across the loan’s life.

Your instalments alter based on the number you take aside and you may one month’s rate of interest. That upside is that you pay only interest towards count your withdraw rather than towards full number acknowledged. Concurrently, rates usually are lower than your own mediocre mastercard, and repayments try tax deductible.

This is an excellent alternative whenever you can pay back the fresh new number your obtain reasonably quick- thanks to selling an alternate property, the next spend improve, or an inheritance.

Restoration Capital Financing

If you don’t have far guarantee of your house, think a renovation mortgage. Because of it financing, your re-finance your existing domestic and add the number needed for the fresh ree financing. The financial institution angles the borrowed funds on your residence’s projected well worth once the restoration online personal loans Kansas is finished. This means its one to large loan, not a moment mortgage.

That it mortgage is intended to finance home home improvements that will improve the worth of your home. It will take that you manage authorized builders. In place of paying a lump sum payment right to your, the lender will pay the latest company as job is done.

Cash-Away Refinancing

Cash-aside refinancing is much like recovery capital but has numerous high variations. Earliest, lenders legs the mortgage solely into the latest worth of your own domestic. That implies you should have equity in your home. Your own brand-new mortgage loan might be paid down, therefore the amount necessary for the fresh renovation might possibly be added to you to costs and you can rolled more than toward the fresh financial.

At exactly the same time, money to suit your restoration are offered directly to you in the you to definitely cash commission. You’re in costs out-of make payment on contractors, therefore please Diy otherwise contact your area handyman.

That it loan is advisable in the event that most recent rates is actually lower. Just like any smart re-finance, you could reduce your rate of interest and you can utilize your collateral to finance a remodelling. Its essentially a-two-for-you to definitely special.

Create the best Choice

Any extreme economic choice boasts individuals dangers. Before signing into dotted range, speak to your accountant otherwise monetary coach. They’re going to help you weigh the benefits and you can disadvantages of each alternative in order to confidently financing your property recovery in Tx.

Don’t hesitate to touch base which have any queries otherwise issues you enjoys just like the a homeowner. I am able to help you know very well what home improvements might possibly be suitable investment and comment your loan choice so you can optimize your financial support.