Brand new , observe solicited social comment to have a time period of a month. No matter if, as more fully discussed for the Sections III and you can IV associated with notice, numerous social commenters compared HUD’s proposition to make usage of risk-based premium but don’t totally give an explanation for reasons for having new resistance, almost every other commenters elevated very important installment loans Washington issues for HUD’s attention and you will provided guidance you to HUD will be embrace. For this reason, shortly after mindful comment and you will believe of one’s public comments, HUD will apply chance-depending advanced, as given within this see, having specific revisions produced after consideration from social statements. HUD are continuing to apply exposure-built advanced on the grounds indicated regarding the ely, one including a pricing system will allow FHA so you can suffice a beneficial selection of consumers and will help make sure the monetary soundness regarding FHA applications that are financial obligation of MMIF. These types of plan grounds are more totally discussed into the Section III out-of so it observe.

- The newest effective day try altered out-of , having FHA loans where situation number try tasked into the otherwise upcoming go out.

- The latest classifications used in the fresh new initial advanced price table was altered away from lowest deposit so you’re able to loan-to-value (LTV) ratio.

- Source of advance payment are got rid of since the a factor in determining the fresh borrower’s mortgage top.

- Consumers with nontraditional borrowing meet the requirements getting 97 per cent LTV investment.

- The latest , notice’s supply into the averaging the newest borrower’s credit ratings could have been eliminated and you will substituted for a reduced-decision credit history.

- A changed matrix shows both upfront and you will annual superior to have money which have words over 15 years, and another matrix suggests premium to possess money that have terms of 15 age or fewer.

- Minimal initial advanced is elevated of 75 basis factors to 125 foundation items for mortgage loans over 15 years, and regarding 75 basis points to 100 base points to own mortgage loans out of fifteen years or less.

III. Report about Key Personal Comment Inquiries in addition to Need for Execution away from Chance-Established Superior

At the romantic of your own societal opinion period on the , HUD obtained 176 public comments. These types of societal comments originated from many different supply, including the general public, financing officials, mortgage organizations, local and you will national banks, state homes loans enterprises, some organizations representing the brand new welfare of home loan lending and you will family strengthening industries, private financial insurance firms, seller-funded down payment assistance team, and businesses bringing recommendations management options characteristics.

While many of one’s commenters compared chance-built premiums, the vast majority of failed to demonstrably share the cornerstone due to their resistance. These commenters stated that chance-mainly based advanced do harm ab muscles individuals FHA is dependent so you can serve, but considering zero advice otherwise need to support that it claim. Other commenters stated that HUD don’t need incorporate chance-founded premium and you can dump deposit advice; that is, this and/or most other will likely be sufficient to address highest chance mortgages. (These statements although some become more completely addressed into the Area IV for the find.) ( printing webpage 27705)

You to definitely commenter stated that in the event that exposure-based advanced try accompanied, FHA offers merely costly, conventional-type financing and can quit to simply help straight down-income individuals whom portray the target listeners to own FHA insurance rates

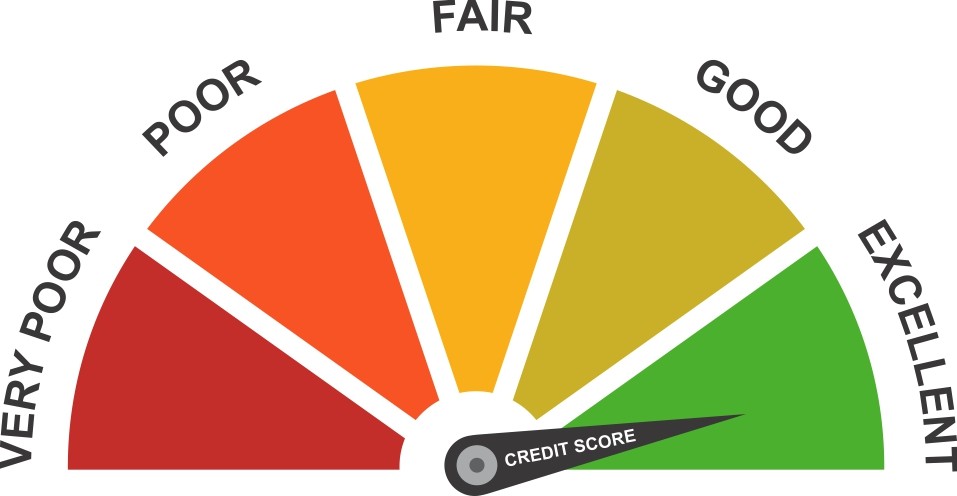

FHA was applying chance-centered premiums to get its goal to market homeownership one of first-some time and minority homebuyers. Since antique business frequently spends exposure-depending superior in order to speed insurance coverage exposure, FHA, at this point, continues to charge a single-size-fits-all premium in order to mortgagees, causing down-risk consumers investing a top premium than necessitated from the the exposure, and higher-exposure consumers paying a diminished superior in accordance with the exposure. The newest criteria one to FHA offers to have fun with to have chance-based premiums-credit scores and you can LTV ratios-is highly of the allege costs and also become the no. 1 risk points used in traditional industry cost of home loan borrowing risk. FHA have a legitimate providers reason for billing higher advanced to higher-risk borrowers. In fact, it has got a business imperative, as newest FHA type average-risk price is not alternative.