step 1. PenFed Borrowing Connection

PenFed Borrowing from the bank Connection has the benefit of Virtual assistant construction finance having each other one-time and a couple-go out intimate selection, providing to a broad registration ft. They focus on delivering designed monetary selection designed to meet up the new certain framework requires of its members. PenFed’s means prioritizes financial show and you may satisfaction, making sure a silky excursion about household-strengthening processes?

3. Navy Federal Credit Commitment

Navy Federal Credit Commitment even offers Virtual assistant build fund in order to an over-all spectrum of army staff, extending better outside of the Navy. Known for the positive words, these types of loans try customized into book items away from armed forces users, and come up with homeownership more attainable. Navy Federal’s comprehensive and flexible qualification criteria allow it to suffice a varied army society, so it is a flexible and you can common choice for people seeking construct their own household.

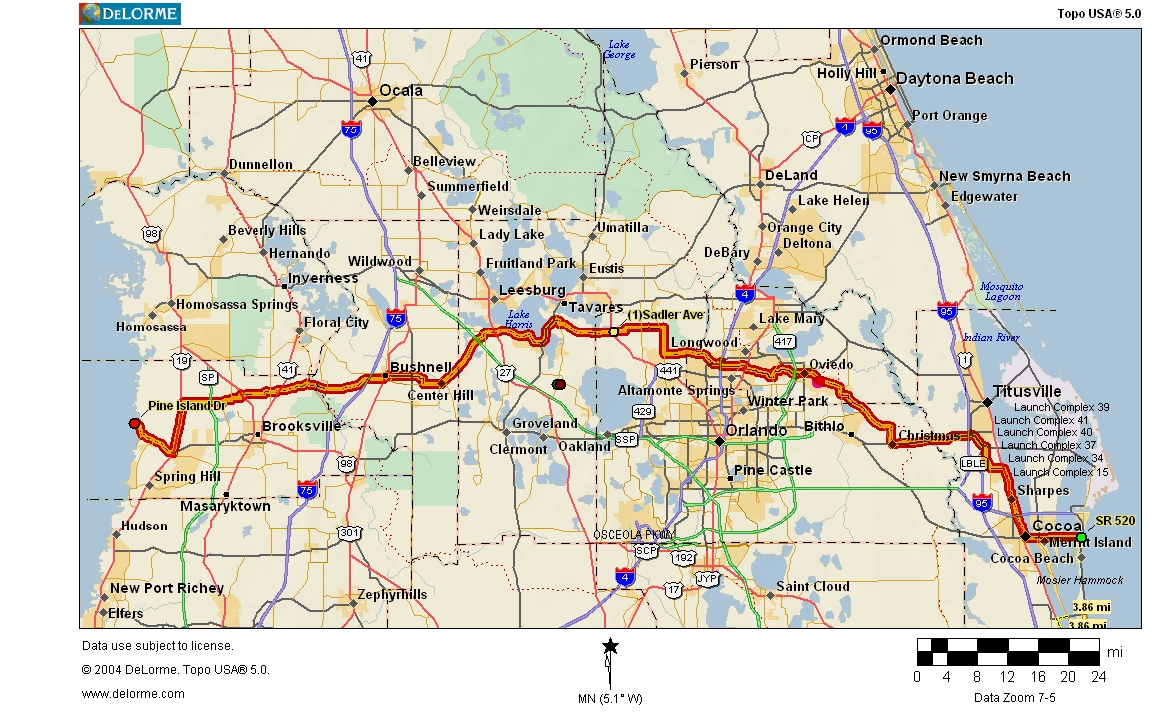

cuatro. Flagstar Bank

Flagstar payday loans online Florida Financial will bring numerous mortgage choices along with Virtual assistant framework loans. They give focus-just costs throughout design, which will surely help carry out cash flow during the strengthening procedure. Flagstar is acknowledged for the novel financing alternatives and you can self-reliance, it is therefore a stylish choice for pros trying generate the homes?.

5. The brand new American Resource

Brand new Western Resource also provides a variety of mortgage activities also Virtual assistant design finance. They emphasize helping underserved teams and supply options customized to basic-go out homeowners, military participants, and people with unique financial situations. Its commitment to customer care and you may complete solution makes them an excellent prominent selection for Va construction finance.

six. PrimeLending

PrimeLending is known for getting flexible build loan choices, along with those people supported by Va claims. They are committed to meeting the diverse means of their subscribers, along with experts against unique or complex construction pressures. PrimeLending’s work on independence and you can comprehensive options means they are a significant merchant for those investigating Va structure finance?.

7. Veterans Joined Mortgage brokers

Pros United Home loans, while not actually providing Virtual assistant structure fund, support veterans inside acquiring conventional construction finance and then refinancing for the Va financing. They give intricate advice on techniques, helping pros navigate the reasons out of resource family structure.

8. Fairway Separate Home loan Firm

Fairway Separate Mortgage Organization also provides comprehensive features into the Va fund, along with choices for construction financing. He is recognized for its total method, which simplifies the brand new transition out of framework funds in order to permanent mortgage loans. Fairway’s work at customer education and you will service underscores their dedication to delivering comprehensive and you will academic financial qualities so you’re able to experts?.

9. LendingTree

LendingTree assists link individuals with Virtual assistant structure loan companies and provides intricate suggestions through the application and you may framework processes. The platform lets experts evaluate multiple financing even offers, guaranteeing they find a very good terms and conditions and pricing because of their framework needs?.

ten. New Government Discounts Bank

The new Federal Discounts Bank now offers Virtual assistant design fund and provides in depth support regarding framework techniques. It stress deciding to make the house-building journey down of the extracting the method to your trick actions, of obtaining a certificate off Qualifications to finalizing the mortgage and you may starting framework. Its complete services makes them a reliable option for experts searching to build their homes?.

Choosing the right Virtual assistant Build Loan Lender

Whenever choosing a loan provider for a Va design financing, thought items like the lender’s expertise in Va finance, customer service profile, and the freedom away from financing conditions. It is additionally vital to consult lenders exactly who particularly render Virtual assistant framework finance, because not totally all Virtual assistant loan providers offer this particular service. Always contrast offers away from numerous lenders to ensure you have made the new better conditions ideal for your financial needs and you can design specifications.

By the understanding the basics out-of Virtual assistant construction loans and you will exploring reputable loan providers, qualified experts and you will service members takes extreme tips for the building their unique residential property with good loan terminology.