Which have a cash advance Larkspur loan zero-closing-cost home loan, their financial pays settlement costs at the start. In the course of time, even when, you’re going to be paying off your lender of these closing costs. You’ll be able to pay courtesy sometimes increased interest rate or by taking out a larger financing.

No-closing-prices mortgage loans can help you be able to purchase a house―even if you lack lots of cash easily accessible. In the long term, you will be expenses much more to possess a no-closure prices financial. Use this self-help guide to financial-paid closing costs to decide in the event the a no-closing-costs mortgage will probably be worth it to you personally.

A no-closing-rates financial ensures that you, the home buyer, do not shell out people initial settlement costs in your brand new home. As an alternative, their bank will cover specific or any closing costs.

1. You order lender credits by paying a top interest rate to your your financial. Bank loans are the reverse out of financial circumstances. Therefore unlike paying significantly more upfront to acquire a lower life expectancy attention rates, your commit to increased interest and you will pay quicker from the closing. This may make you a high payment and you may overall mortgage installment amount.

dos. You take away a more impressive financing and you will move settlement costs for the your own home loan. Which shouldn’t connect with your interest, but it usually however connect with the monthly payments and you will overall installment matter.

Which have sometimes means, your bank pays closing costs― you have a higher loan commission per month. You will shell out way more when you look at the attention throughout your loan title.

Just how much was closing costs?

Domestic customer settlement costs always vary from 3–5%. (So when a property visitors, you don’t have to care about real estate agent profits.)

Household suppliers can expect to spend 1–3% in conclusion will set you back. That will not were a property commission fees, though. Vendors basically pay a unique 5–6% of the house income rates during the real estate agent percentage at the closure.

Just what charges are included in settlement costs?

The exact closing costs is dependent on your local area, sales contract, or any other activities. But generally speaking, we provide consumer and you will supplier closing costs to pay for following the fees:

How come I need to spend settlement costs?

Settlement costs safeguards all types of costs for your home buy. Your settlement costs covers essential things such as for instance legal fees, property taxation, and much more. Along with, your settlement costs will help pay money for issues probably proper care about―such a house appraisal and you will assessment.

Imagine if I can’t pay for settlement costs?

If you cannot manage settlement costs, you can consider to locate anybody else to cover all of them to have your. You could pose a question to your lender to own a zero-closing-costs home loan, including. Or you can ask our home provider to help with closing will cost you. It is possible to consider domestic buyer rebates to store plenty in the closure.

Your own almost every other choice? Save up. Lender-paid back settlement costs otherwise seller support can end charging your way more ultimately. If you can save right up adequate to buy closure will set you back, you might find new discounts can be worth brand new wait—specifically if you thinking about residing in your home having a good when you find yourself.

On the plus front side, lender-repaid closing costs enable you to just take money you would provides lay on closing costs and set it on the the down payment instead―giving you a much bigger downpayment. Otherwise it can help you order a property even though you lack much cash on give.

But to shop for financial credits or a high amount borrowed to fund settlement costs tend to both increase your payment per month and also the overall level of appeal you pay.

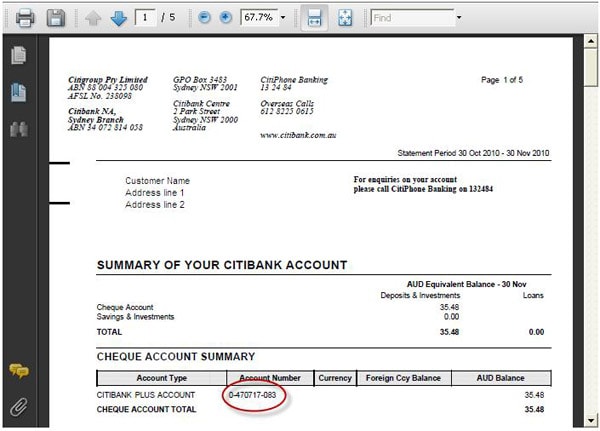

Particularly, assume you’ve got a good $2 hundred,000 29-year financial. Brand new dining table less than shows exactly how their interest rate you’ll get bank credits to fund closure. It’s also possible to observe how that may affect their payment per month and the quantity of desire you have to pay more than 3 decades.