Which one is the best should you want to get a home: An excellent Va loan, FHA loan, or a conventional loan? A simple answer might look like this:

Va mortgage: Fool around with for those who have qualified You.S. armed forces provider, usually 3 months away from productive obligations or half dozen many years throughout the National Shield otherwise Reserves. Such funds essentially render greatest pricing and you can conditions than simply FHA otherwise antique.

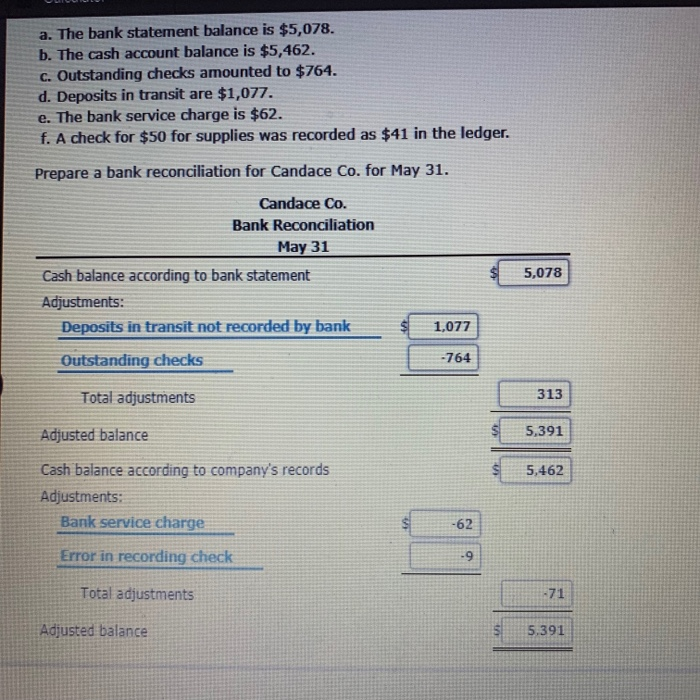

Va compared to FHA against Conventional Evaluation

It’s not hard to see why anybody manage prefer an excellent Va financing whether they have eligible army service: down cost, no deposit, no month-to-month home loan insurance rates.

Va Loan: Ignore This option For those who have No Armed forces Provider However, Understand Cautiously If you

When you yourself have zero military provider, there’s no need to review up on Va fund. While they offer fantastic terms, you truly need to have served as qualified, zero exclusions.

Va Mortgage Pros

Very first, so it mortgage includes down prices than FHA otherwise conventional. Centered on Optimal Blue, a mortgage app business one tracks cost all over tens and thousands of loan providers, rate averages into earliest one-fourth of 2023 are listed below:

Virtual assistant Loan Cons

One of the few drawbacks to the Va mortgage would be the fact it requires an initial financing payment out-of dos.15% of amount borrowed (high to own repeat profiles). Which is $six,450 for the a $3 hundred,000 mortgage. It fee is wrapped on home loan.

Another trouble with this type of money is that manufacturers may not undertake Va now offers for the aggressive locations. Brand new Agencies of Veterans Issues imposes even more stringent possessions standards and this can cause the vendor and come up with fixes just before closure.

Whom Need to have An FHA Financing?

FHA money are fantastic of these which have a tiny down payment and you will a mid-to-lower credit history around 680 or down.

Note: For a further diving towards the FHA finance in place of traditional capital, look for FHA vs Conventional Financing: That is Most useful To own Homeowners?

FHA Financing Advantages

FHA money much more forgiving regarding lower credit. The government insures lenders up against borrower default. Consequently, lenders accept a greater variety of borrower profiles.

In addition, FHA costs are more effective for many lower-borrowing from the bank individuals. Traditional money off Fannie mae and Freddie Mac enforce exposure-situated charge you to convert to higher prices. Those who work in down credit sections spend even more. Possibly, alot more.

FHA is one-price matches all the regarding cost. Somebody which have a great 740 get will pay the same speed because somebody having a great 640 rating (although some loan providers enforce their unique highest prices to have all the way down ratings).

But not, traditional might still end up being your greatest wager whenever you are for the a beneficial low income group, as would-be discussed lower than.

FHA Mortgage Downsides

Earliest, FHA funds include an upfront financial advanced of 1.75% of loan amount. This is exactly equivalent to $5,250 for the a beneficial $three hundred,000 loan and certainly will feel wrapped into mortgage. This escalates the borrower’s commission and financing harmony.

Likewise, FHA month-to-month financial insurance is owed for as long as the fresh homebuyer retains the borrowed funds. Old-fashioned home loan insurance drops out-of in the event the debtor is located at 20% equity. With FHA, the fresh new borrower has to re-finance regarding FHA for the a conventional mortgage to eliminate home loan insurance.

Which Should get A conventional Mortgage?

Whenever you are conventional finance want as little as step 3% down, people with larger down money 5-20% installment loans online in Louisiane will get a knowledgeable rates and you can mortgage insurance policies accounts.

Antique Mortgage Benefits

First, conventional finance do not require an initial home loan insurance coverage payment, preserving the fresh new borrower more than $5,000 into a good $300,000 financing compared to the FHA.

Second, traditional money have cancelable private financial insurance policies (PMI). You can consult that financial insurance coverage go off when you come to 20% collateral. PMI instantly falls out-of on twenty-two% collateral.

Understand that i said traditional financing score quite expensive for these with all the way down credit ratings? There is a huge exception to this rule.

This type of agencies waive all the risk-built mortgage charge to own earliest-go out buyers exactly who create no more than 100% of its town average money or 120% in the highest-costs elements. These costs are called Loan Top Rates Modifications or LLPAs.

Such as, a premier-income or repeat buyer with an excellent 650 credit score and you will 5% off would usually spend a fee equivalent to 1.875% of your own loan amount, translating in order to an increase about 0.50-1% highest. Nevertheless the payment are waived to have average-earnings first-date people, yielding a pleasant rates discount.

As the a customers, you should never just be sure to find out whether or not FHA otherwise conventional usually give a better price or lower payment. There are too of numerous factors at gamble. As an alternative, inquire about both rates from your lender.

Old-fashioned Financing Downsides

People who have high personal debt-to-earnings (DTI) rates, down credit ratings, and you will spottier a job records ple, say some body provides a 52% DTI, meaning 52% of its gross income will go on the monthly obligations payments and the upcoming mortgage payment. They will most likely not qualify for a conventional mortgage, but may very well qualify for FHA.

Which do you ever choose? Va, FHA, or Traditional?

Look at your qualification for every mortgage sort of, up coming require monthly and upfront will set you back into the funds getting you be considered.