What is a great Chattel Loan?

Real-estate is defined as property, all of the forever connected formations to this belongings, as well as the liberties out-of control. Concurrently, a beneficial chattel mortgage try secure of the some individual possessions that is movable. The latest borrower for the a good chattel financing will most likely not individual the new house where the possessions is so an excellent chattel mortgage remains intact also if your property is moved of-web site. Chattel financing was a common source of a created home. According to the Consumer Financial Coverage Bureau (CFPB), on 42% off financing used to pick are built house was chattel financing. These types of moveable are designed house are considered private assets, that is why he or she is both called mobile residential property.

What Manufactured Belongings qualify having a beneficial Chattel Mortgage?

Once are manufactured land was constructed and you may transferred to the website, if they are maybe not situated on piers, wood pillars, a very good foundation, otherwise a basements, up coming they’re felt private property and therefore wanted an excellent chattel mortgage. Even though the framework try hidden in addition to house normally will not circulate immediately following it’s been place, these are produced home still keep a long-term body getting transportation. This means that, this type of house might still getting commonly referred to as cellular property.

Prior to Summer fifteen, 1976, the fresh conditions mobile household and you can are formulated family were used interchangeably and you can met with the same meaning. On that date, the newest You.S. Casing and you may Metropolitan Creativity (HUD) then followed more strict requirements getting cellular property. This means that, belongings are produced next go out is commercially known as are manufactured land, while you are home built ahead of one big date are mobile home. These types of HUD criteria apply at the shape, framework, transportability, fuel, energy efficiency, fire opposition, and you may full quality of the newest are built household.

- Minimum FICO get try 575*

- Minimum loan amount try $thirty five,000.

- Maximum amount borrowed try $275,000.

- The brand new unmarried otherwise multiple-section are created residential property meet the requirements.

- As little as 5% down**

- Of up to fifty% debt-to-money rates.

- 20-23 year terms.

**5% deposit was at the mercy of more lowest FICO and you may continual income conditions. Delight correspond with that loan Administrator for additional information on down fee and you can FICO score lowest.

- No repossessions into the a car loan over the last 2 years.

- No range membership more than $step one,000 unwrapped over the past 1 year.

Which are the Benefits associated with a beneficial Chattel Mortgage?

You believe that chattel loans are exactly the same matter since regular conventional financing. That is not the truth regardless of if, given that chattel money promote their unique pros. Some https://www.cashadvanceamerica.net/ of the more critical ones through the adopting the:

***Taxation deductibility interesting varies. Demand a taxation elite to determine if chattel financing appeal can get end up being tax-deductible on your condition.

What Measures If you Attempt Qualify for a Chattel Mortgage?

Chattel financing are available compliment of are created mortgage lenders while is get in touch with these firms privately. Before you can do although, you will want to realize a number of procedures:

After you’ve done the individuals strategies, you’ll want to complete the application and you may safer your own down-payment, when the appropriate. Having the ability to finish the app is also alter your probability of being qualified to the chattel mortgage.

Just what More Should you decide Understand Chattel Funds?

Remember that if you have good chattel financing and eventually standard involved, the lending company takes arms of one’s own property. Try making fast and you can complete money to stop losing their household. For this reason you should really works closely with a produced family lender, because the that providers understands the fresh particulars of the industry.

When you find yourself finding buying a created domestic, an effective chattel loan might be the perfect services. Whether or not you may have even more questions about the process otherwise are searching and also make a home buy which have an effective chattel financing, Cascade makes it possible to. We have been running a business as the 1999 and also grown up being among the many greatest are formulated financial providers in the united kingdom. Contact us now and we can help you begin your papers today!

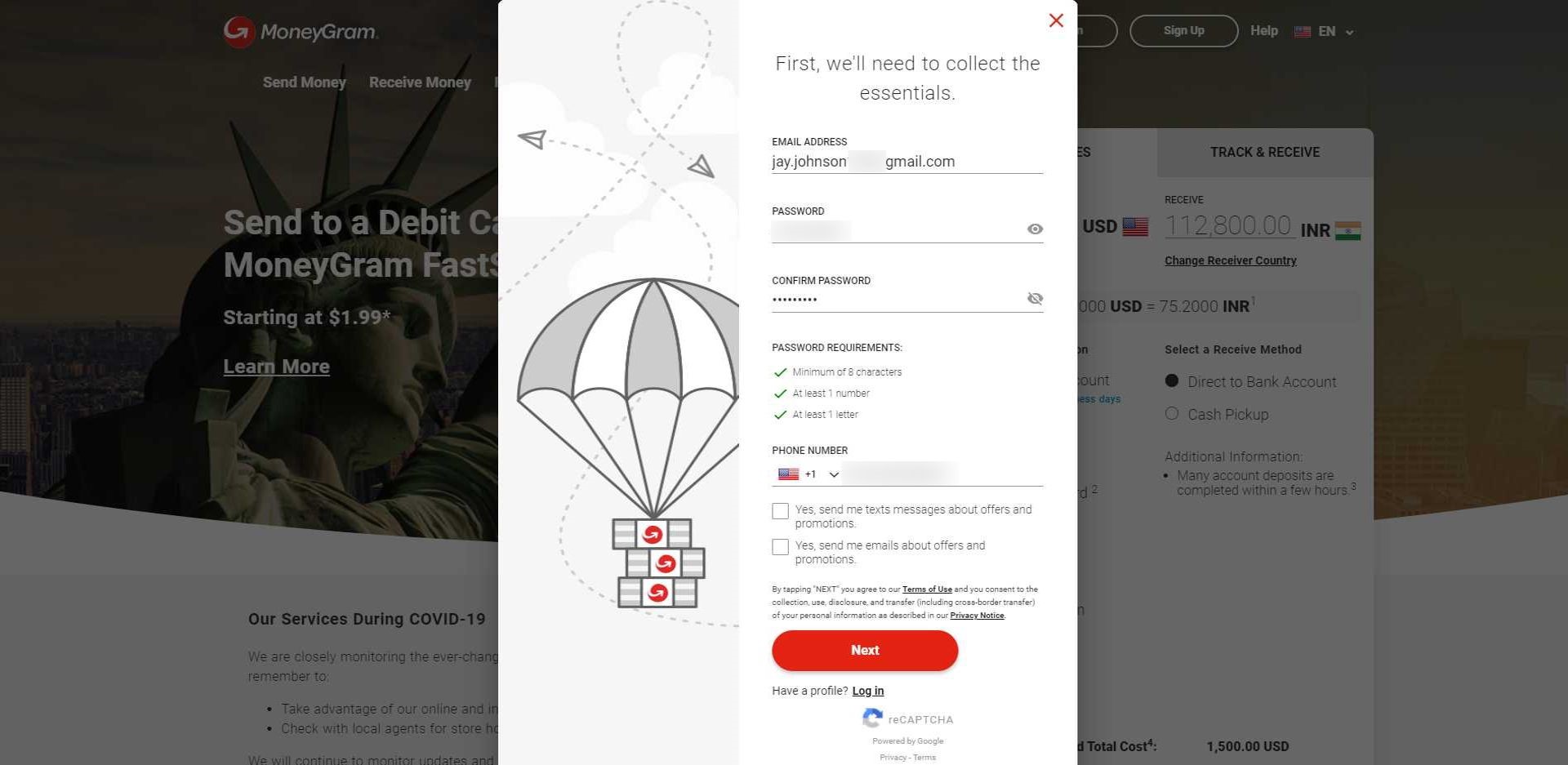

E mail us within (877) 869-7082 for additional information on our FHA standard and you can are built house loan programs, otherwise start-off straight away by the completing all of our on the internet prequalification.